Market Cycle Psychology: What You Need to Know

|

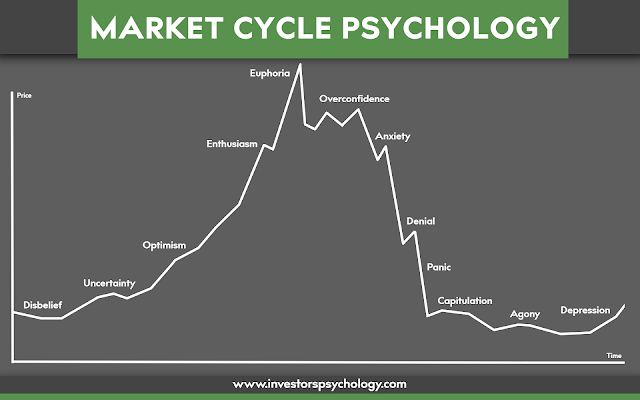

Market Cycle Psychology

Market cycle psychology is an interesting phenomenon. The price trend in different markets tend to follow certain patterns (whether it's stocks, commodities, housing, or cryptocurrencies). This holds especially true in a so-called market bubble. Market cycle psychology is not an exact science but can roughly be explained by the nature of human psychology in relation to fear and euphoria, as well as collective thinking.

Fear and euphoria play an important role in investors psychology in general. Fear of regret, for example, is a well-known concept that refers to the human mind anticipating regret and subsequently avoiding it. The infamous FOMO, also known as fear of missing out, is strongly dictated by fear of regret.

Strengths and Shortfalls of Market Cycle Psychology

Understanding the concept of market cycle psychology can be beneficial on a macro scale when determining in what strategic direction you want to take your investments. Knowing in what part of the cycle you are (in a given market) can protect your investments. For example, you can start hedging your investments and partially take profits if you suspect that you're in the euphoric phase of the market cycle, thus softening a later downturn.

However, the market cycle psychology cannot be used as a tool to guide individual investments. Company stocks and individual cryptocurrencies are much more heavily affected by other external factors, and you can't be sure that they'll be moving with the general market. As for using the concept on a macro scale, even if you are fairly confident of where the market is in the cycle, there is a risk in not knowing for how long that part of the cycle might last. The market can stay irrational longer than you can stay solvent, as the famous economist John Maynard Keynes once said.

Investor Psychology Tip:

Become a better investor and earn more about the stock market psychology and its cycles in particular.

|

| The Market Cycle Psychology Chart |

Parts of The Market Cycle

These are the different emotions reflected on the market cycle psychology chart presented above. Each emotion corresponds to a following type of behavior in the masses. Simply put, you just got to outsmart the herd.

Disbelief

Due to strong previous negative returns the fear of further losses outweighs everything else.

Uncertainty

For most it's unclear where market is heading, but skilled investors optimally enter the market at this point

Optimism

At this point the herd sentiment is beginning to form due to positive price dynamic. The message is spreading among investors.

Enthusiasm

Outsiders rush into buying the successful investment

Euphoria

The famous 'investors high' spreads among investors. "It can only go up", nonetheless the market is peaking.

Recommended Read:

Why Money Can't Buy Happiness

Overconfidence

Seeing how high returns the investment can give the recent herd of investors who bought positions are overly confident that the price will continue to rise.

Anxiety

The price is beginning to drop as most skilled investors have sold at this point and anxiety starts to set in for those still invested.

Denial

Investors will ignore any warning signs that the market is on a significant downturn

Panic

Price is plummeting, loss is immense, the previously overconfident investors are now rushing to sell.

Capitulation

Most have exited the market at this point

Agony

Strong emotional difficulties present themselves to the few who have yet to sell. The market cycle is beginning to reset.

Depression

The market is about to start the process of recovering long term, but for the investors any hope is gone, and emotional indifference is stronger than ever.

... and then it starts from the beginning again.

Conclusion

Use this information to your advantage. By understanding your own emotions and how you react to them you can make better investment decisions when it comes to stocks, commodities or cryptocurrency. By reading articles about investors psychology, you can educate yourself further and be more successful as an investor. The market cycle psychology is only one of the concepts you should know about.